Use Case #1 – Correct Personal Budgeting

Thomas, 26, London

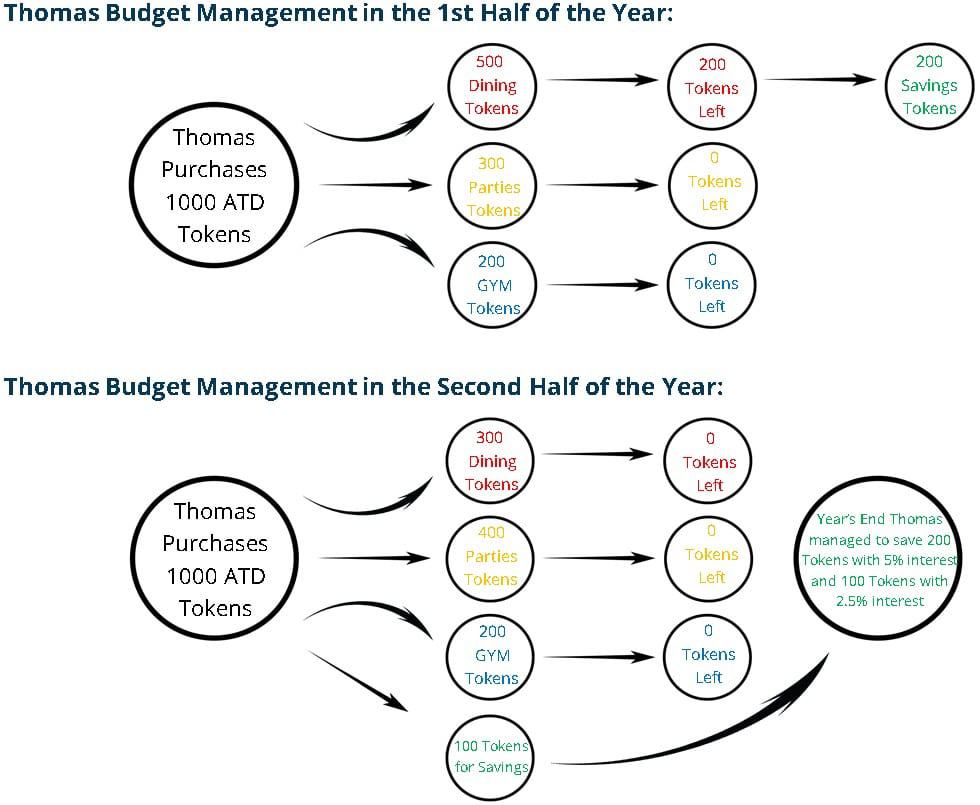

Thomas purchased 1,000 ATD tokens and decided to divide them into three sub-currencies:

500 tokens were painted red and designated for dining.

300 tokens were painted yellow and designated for parties.

200 tokens were painted blue and designated for gym payments.

After half a year, Thomas realized that he had spent his entire budget on parties and the gym, and he had no money left.

However, he still had 200 tokens to use in restaurants. He chooses to keep the remaining tokens in his wallet for future savings.

After tracking his expenses, he purchases 1,000 ATD tokens again, this time divided differently:

300 tokens were painted red and designated for dining.

400 tokens were painted yellow and designated for parties.

200 tokens were painted blue and designated for gym.

He also set aside 100 savings tokens that were combined with the 200 tokens that were not consumed in the first six months.

After using the app for a year:

1. Thomas understood exactly how his budget had been divided.

2. He managed to save money:

200 tokens had gained interest at a rate of 5% + the increase in currency value.

100 tokens had gained interest at a rate of 2.5% + increased currency value.

3. Thomas now knows how to plan his budget for next year and even needs to invest less money because of the prior years’ savings.